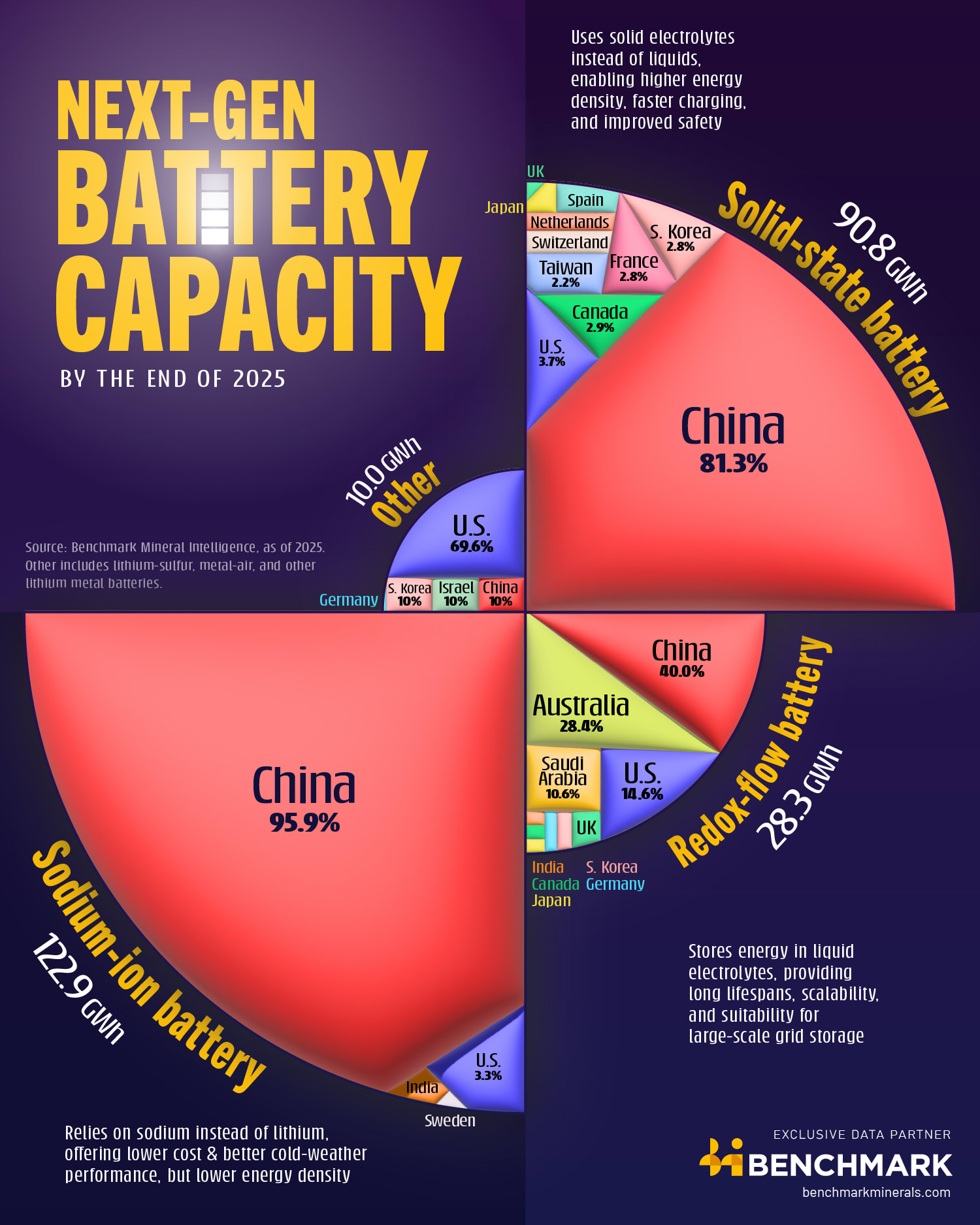

Infographic: The state of play of next-generation battery capacity in 2025

The next-generation battery landscape has progressed from start-up to scale-up, with more than 250GWh of pipeline capacity expected to be installed by the end of 2025 across a variety of emerging technologies, according toBenchmark’s New Technology Service.

China has a dominant position in the two most developed of these technologies: sodium ion and solid-state. The country is using its existing expertise in lithium ion cell production, as well asstate support, to push for significant capacity buildout ahead of demand being fully realised.

Sodium ion batteriestake top spot for installed production capacity, with 123GWh expected to be online by the end of the year. The technology aims to compete withlithium ion batteries on costand safety, especially in battery energy storage systems.

However, low utilisation rates and depressed lithium raw material and cell prices present critical commercialisation challenges, which must be overcome for widespread adoption.

Watch:Sodium ion batteries: Hype vs reality on the road to commercialisation

Over 95% of installed sodium ion battery capacity is in China. The country is also home to four-fifths of thesolid-state battery capacityplanned for operation by the end of 2025, which is set to reach 91GWh globally. Solid-state batteries promise higher energy density, faster charging, and reduced risk of battery fires, though high initial cost means this technology will likely first be applied in thepremium EV segment.

Other next-generation battery technologies are less concentrated in China. Sizable amounts of production capacity forredox-flow batteries, which store energy in liquid electrolytes, is located in Australia (28%), the US (15%), and Saudi Arabia (11%), in addition to China (40%). Nearly 30GWh of redox-flow battery production capacity is set to be online by the end of this year.

The US dominates the capacity pipeline for more niche next-generation technologies includinglithium-sulphur, metal-air, and other lithium metal batteries. The country is set to account for 70% of the 10GWh global market for these technologies by the end of 2025.

As the global energy landscape rapidly evolves, emerging battery technologies are poised to reshape markets and unlock new commercial potential. Benchmark’s New Technology Service identifies the key disruptors and technology trends driving this transformation. To learn more fill out the form below:

>

>  >

>  >

>  >

>  >

>  >

>  >

>  >

>